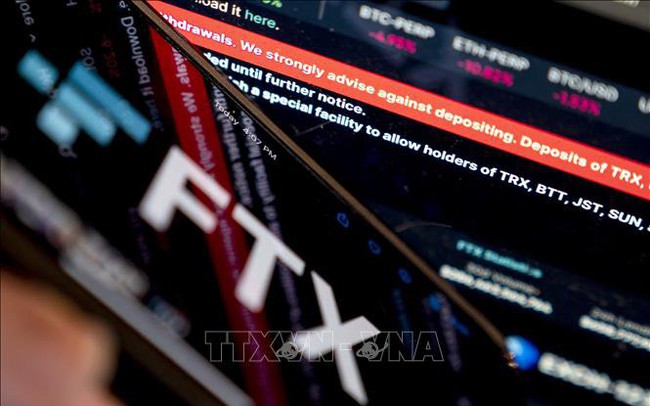

FTX bankruptcy: Binance CEO warns of crypto crisis, Fed will closely monitor

Regulators have launched a series of investigations following the sudden collapse of crypto exchange FTX last week, while rival exchanges sought to reassure investors worried about the fall. their own stability.

11/ 15-2022 No chip CCCD yet, how can I look up personal identification code?

November 15 , 2022 Social network in danger of collapsing advertising revenue

11/ 15-2022 Seafood export: Digitizing to overcome IUU "yellow card"

A source familiar with the matter said that the rapid collapse of FTX - the once darling of the crypto industry with a valuation of $ 32 billion in January 2022 - prompted a series of investigations from the Ministry of Finance. US Justice, US Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC).

A second source with information about the investigations said that the SEC is also targeting FTX regulators, finding out how knowledgeable they are about handling customer funds and whether there are any possibilities. violate any securities laws.

In an interview with Bloomberg news agency, Federal Reserve Vice Chairman Lael Brainard also said that the crypto industry has always emphasized that digital assets are fundamentally different from financial instruments. traditional. However, the sector has shown similar vulnerability to the traditional market and is therefore subject to equivalent rules.

Sharing the same view, Michael Barr – a top management official of the Fed also signaled that the authorities will monitor the cryptocurrency market more closely. In a written testimony published ahead of his appearance on the Senate Banking Committee on Tuesday (local time), Barr said that regulations need to be put in place to ensure crypto companies are subject to the same rules as other financial companies.

FTX filed for bankruptcy protection last Friday (11/11) and became one of the biggest “booms” in the crypto market after “crazy” traders withdrew 6 billion VND. USD from the platform in just 72 hours, and rival exchange Binance reneged on a deal to rescue FTX.

Sam Bankman-Fried, former Chief Executive Officer (CEO) of FTX, said his company has expanded too quickly and cannot meet that growth rate.

Bitcoin dipped below $16,000 to 1 bitcoin early Monday, before recovering and trading at $16,401 at 5:56 a.m. local time (UTC).

* Attempts to reassure investors

The rapid demise of FTX – once the “rescue knight” for crypto companies in dire straits – has sent shockwaves throughout the crypto industry. The most prominent names are preparing for the next negative spillover effects.

Many cryptocurrency exchanges have released details of their reserves, pledging to reveal more information in an attempt to ease the sentiments of investors who are floundering amid unconfirmed rumors. bright.

Cryptocurrency lender BlockFi says it has significant exposure to FTX. Previously, this company signed an agreement with FTX to provide a revolving credit facility worth $400 million.

Kris Marszalek, CEO of Singapore-based crypto exchange Crypto.com, dismissed suggestions that the exchange is in trouble following the collapse of FTX.

During a YouTube live stream, Mr. Marszalek said that Crypto.com always maintains the right amount of reserves for every coin that customers hold on the platform. He also confirmed that audited evidence of Crypto.com's reserves will be published within the next few weeks. Even so, the Wall Street Journal reported that withdrawals from Crypto.com increased late last week.

Crypto.com is among the top 10 crypto exchanges in the world by revenue, but it is still smaller than FTX and the market leader is Binance.

Another crypto exchange, Kraken, said on Twitter on Sunday (November 13) that it had frozen the accounts of FTX and its affiliated crypto exchange Alameda Research and its regulators. their executive level.

Meanwhile, LedgerX LLC, a subsidiary of FTX, on Monday withdrew its request from December 2021 to the CFTC to allow it to offer products that are not fully collateralized.

Trieu Truong Bang, CEO of Binance, said he will seek to create an industry recovery fund to help projects that are strong in other respects but are facing a liquidity crisis.

Binance last week signed a non-binding letter of intent for FTX's purchase of non-U.S. assets but subsequently reneged on the agreement, resulting in the bankruptcy of FTX. Since then, Trieu Truong Bang has warned of an impending crypto crisis.

Operate and exploit advertising by iCOMM Vietnam Media and Technology Joint Stock Company.

Adress: 99 Nguyen Tat Thanh, To 2, Khu 6, Thi tran Tan Phu, Tan Phu, Dong Nai.

Email: [email protected] | Tel: (+84) 984654960

Editor in chief: Tran Nha Phuong

Company: Lucie Guillot (Nha Phuong Tran)